Center

Exporters remain upbeat despite threat of higher prices

By Ding Qingfen (China Daily)

Updated: 2007-05-11 08:48

|

Large Medium Small |

Chinese manufacturers believe they can maintain solid growth on export this year despite expectations of higher prices, according to China Supplier Survey recently launched by Global Sources.

| |||

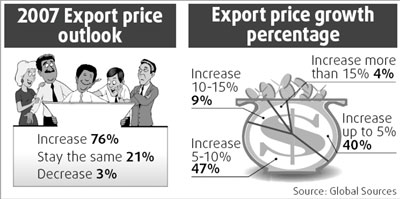

Prices of a range of China-made products will stay on an upward spiral this year, the survey revealed. Some 76 percent of the suppliers surveyed expect to raise prices this year, but most are planning to limit the price increases to less than 10 percent. This compares with 70 percent in Global Sources' previous survey for the first half of 2006.

The price-increase measure aims to ease the pressure from higher operating expenses like sustained high cost of key raw materials and rising labor costs. In raw materials, the greatest rise was seen in copper, whose price tripled last year compared with 2005.

Labor costs have also continued to climb, particularly for companies in the eastern coastal provinces. The acute shortage of workers in these areas has forced companies to offer higher wages and better non-salary compensation to minimize turnover.

Several companies affected by the EU's RoHS (Restrictions on Hazardous Substances) have also cited compliance with the directive as a factor pushing up operating costs.

According to several respondents, to meet the levels required for lead, mercury, cadmium, hexavalent chromium and other materials, the total production costs have risen by 5 to 20 percent.

This is partly due to the fact that RoHS-compliant raw materials and components are more expensive. Manufacturers have also had to invest in upgrading their management systems and production lines.

However, suppliers are generally optimistic about the export growth and profit level, with orders from overseas buyers expected to increase in coming months, although the margins per unit will get smaller.

Some 78 percent of the companies said they expect sales to increase by 5 percent or more this year. But in the previous study, only 68 percent projected this level of growth. Half anticipate export sales growth of more than 10 percent and many are even increasing capacity to accommodate additional orders.

Increased shipments to the EU are expected to be the main driver of export growth.

Undeterred by the higher cost of compliance with the EU RoHS, most suppliers regard the region as their most important market as they can obtain higher prices compared to the US.

And, many medium and large-sized exporters welcome the restriction as an opportunity to grow exports as competitors unable to meet the requirements will be squeezed out of the market.

With target shifting to long-term growth, many companies surveyed will develop competencies that will help them achieve a more sustainable competitive advantage rather than relying solely on price.

More than 41 percent plan to increase production capability by over 20 percent, compared with merely 32 percent in the previous survey.

About 35 percent will focus on enhancing time-based competencies, specifically in product development and delivery. For 29 percent of suppliers, having a well-trained workforce is of primary importance in light of more stringent product and manufacturing requirements.

More than 20 percent of respondents will be expanding the range of models to meet the needs of different markets and reduce the risk of loss when demand from one segment declines.

(China Daily 05/11/2007 page15)

| 分享按钮 |